Call For Free 15 Minute Consultation(212) 739-7599

Lawline Online Course: A field Manual for Involuntary Bankruptcies - Thursday, 11/5/2020 at 3:00pm EST

Make sure to Reserve your online seat - (Click Here)

Please Note: We are OPEN, continuing to represent clients and accepting new clients However, due to local directives, all meetings and interviews can be conducted via telephonic or video conferencing. Do not hesitate to contact us with any questions, concerns or requests for information. Our free 15 minute telephone consultation remains available.

Call For Free 15 Minute Consultation(212) 739-7599

It’s official. The Coronavirus is having economic consequences. Business owners face falling sales. Workers face layoffs or shorter hours. Each of these means less funds to pay bills and expenses.

So, what’s to do. As always, don’t panic. Similarly, whenever possible, don’t think . . . know. It requires a little more effort. But, the results are usually much better.

Meanwhile, if you’re out of work and have bills to pay, don’t rush into bankruptcy. You want a fresh start, not a false start. Waiting may be the hardest part. It’s also smarter, too. Why?

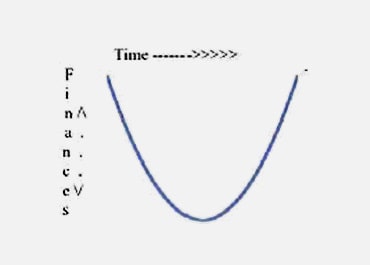

Meet a friend from college: the inverted bell curve

Your crisis begins on the left side. Time takes you to the right side. To get a “fresh start,” for an individual, through chapter 7, it’s best to file at the curve’s very bottom. That way, you put the past behind you and benefit from the future (right side).

Filing prematurely has you on the left side, going down. You don’t know when the crisis is over and may add on debt as things get worse. That means the post-filing debt won’t get discharged. That’s a false start, not a fresh one. Your timing is critical.

Factors may require more immediate action, like a scheduled foreclosure sale or garnishment. Still, thought is required.

You may have assets that creditors can’t take from you: exempt assets. Examples are pensions, IRAs, insurance policies, and home equity. You don’t have to use those resources to pay your creditors. Think three times before you use them to pay a creditor.

You may have assets that creditors can’t take from you: exempt assets. Examples are pensions, IRAs, insurance policies, and home equity. You don’t have to use those resources to pay your creditors. Think three times before you use them to pay a creditor.

Being sued is no fun. Nor, for that matter, is suing. When a creditor threatens to sue you, what does it mean? It means that a court is going to say that the money is owed and the creditor has the right to use legal remedies to locate and take your assets and apply them to their judgment.

Now consider, if all of your assets are exempt, there’s nothing to take. You may need to deal with the judgment later. After your crisis levels out.

Unlike individuals, waiting for the storm to pass could capsize your venture. Wishful thinking and hoping don’t work. You need to understand and deal with what you’re facing. After 2008, we saw business owners who thought that their surviving prior down-turns meant they’d weather that one. They learned, too late, they were wrong and could have avoided their personal catastrophes.

It’s hard to believe that your creditors may be your silent business partners. They want you to succeed so they get paid. Hopefully, that cycle lasts for years. If you’re having problems, communicate with them. You may get more help than expected.

Moreover, silence creates concerns. If they don’t know what you’re doing, they won’t trust you. If they don’t trust you, they’ll sue you.

This is a corollary to don’t use exempt assets. You may be experiencing a “perfect storm” which could wipe out the business. Think four times before putting exempt assets into your foundering business. You will need those assets if the business fails, despite your efforts. If they’re sunk in the failed business, you are really adrift.

You don’t know everything. You probably have misconceptions about bankruptcy, too. It’s not a sign of failure. It’s a tool to preserve what you’ve done. It’s a strategy to succeed. Plus, there are lots of strategies short of bankruptcy which may help. Talk to someone who knows them. There are a bunch of lawyers and accountants who can guide you.

Don’t wait for a letter from a lawyer offering help, after they saw you’re being sued. That means you lost an opportunity to consider all of your options.

Be proactive! If you had real coronavirus symptoms, you’d do something about it, right? Saving your finances and business is no different.

Your time and our time is valuable. That’s why we offer a fifteen-minute (sometimes more depending on the circumstances) free consultation to understand your situation, provide some guidance and help you decide if a paid consultation makes economic sense for you.

You’re welcome to take us up on it. We’re serious.

Meanwhile, stay well.